The Only Guide for Pvm Accounting

Wiki Article

Things about Pvm Accounting

Table of ContentsPvm Accounting for DummiesSee This Report on Pvm AccountingThe Ultimate Guide To Pvm AccountingNot known Details About Pvm Accounting 6 Simple Techniques For Pvm AccountingA Biased View of Pvm AccountingPvm Accounting Fundamentals Explained

In terms of a company's overall strategy, the CFO is in charge of directing the business to fulfill financial objectives. A few of these techniques can include the business being obtained or procurements going forward. $133,448 annually or $64.16 per hour. $20m+ in yearly revenue Service providers have developing requirements for workplace supervisors, controllers, accountants and CFOs.

As an organization grows, accountants can release up a lot more team for various other business duties. This might ultimately bring about improved oversight, better precision, and better compliance. With more sources complying with the path of cash, a professional is a lot a lot more most likely to earn money accurately and in a timely manner. As a construction company grows, it will demand the aid of a permanent monetary personnel that's handled by a controller or a CFO to take care of the firm's financial resources.

Rumored Buzz on Pvm Accounting

While huge companies could have permanent monetary assistance groups, small-to-mid-sized companies can work with part-time accountants, accounting professionals, or monetary consultants as needed. Was this article useful?As the building and construction industry continues to flourish, companies in this market need to preserve strong monetary monitoring. Reliable bookkeeping practices can make a significant difference in the success and growth of building and construction firms. Let's check out five essential accountancy techniques customized specifically for the building and construction sector. By applying these practices, building businesses can enhance their financial security, streamline procedures, and make educated choices - construction taxes.

Comprehensive estimates and budget plans are the backbone of construction job administration. They assist guide the project in the direction of timely and rewarding completion while securing the passions of all stakeholders included.

Not known Details About Pvm Accounting

A precise estimation of products needed for a task will certainly aid guarantee the necessary materials are bought in a prompt way and in the right amount. A mistake below can lead to wastage or delays because of material lack. For many building and construction tasks, equipment is needed, whether it is bought or leased.Proper tools evaluation will certainly assist make certain the appropriate tools is readily available at the correct time, conserving money and time. Do not neglect to make up overhead expenditures when approximating task prices. Straight overhead expenditures are details to a task and might consist of short-term rentals, utilities, secure fencing, and water materials. Indirect overhead expenditures are everyday prices of running your company, such as lease, administrative salaries, energies, taxes, devaluation, and advertising and marketing.

Another aspect that plays into whether a project is effective is a precise estimate of when the task will be completed and the related timeline. This estimate assists guarantee that a task can be completed within the alloted time and sources. Without it, a task may lack funds before completion, creating prospective job interruptions or desertion.

How Pvm Accounting can Save You Time, Stress, and Money.

Precise work setting you back can help you do the following: Comprehend the profitability (or lack thereof) of each job. As job costing breaks down each input right into a job, you can track productivity individually.

By identifying these things while the project is being completed, you avoid surprises at the end of the task and can deal with (and with any luck stay clear of) them in future jobs. One more tool to help track work is a work-in-progress (WIP) routine. A WIP schedule can be completed monthly, quarterly, semi-annually, or each year, and includes job data such as contract worth, costs sustained to date, overall estimated costs, and total project billings.

Fascination About Pvm Accounting

It additionally gives a clear audit trail, which is crucial for financial audits. construction accounting and conformity checks. Budgeting and Forecasting Tools Advanced software offers budgeting and projecting abilities, allowing building companies to plan future projects a lot more accurately and handle their financial resources proactively. File Monitoring Building and construction tasks involve a lot of documentation.Improved Vendor and Subcontractor Management The software can track and handle payments to vendors and subcontractors, making certain timely repayments and keeping good connections. Tax Obligation Preparation and Filing Accounting software application can assist in tax preparation and filing, making certain that all relevant monetary tasks are accurately reported and tax obligations are submitted on schedule.

Getting My Pvm Accounting To Work

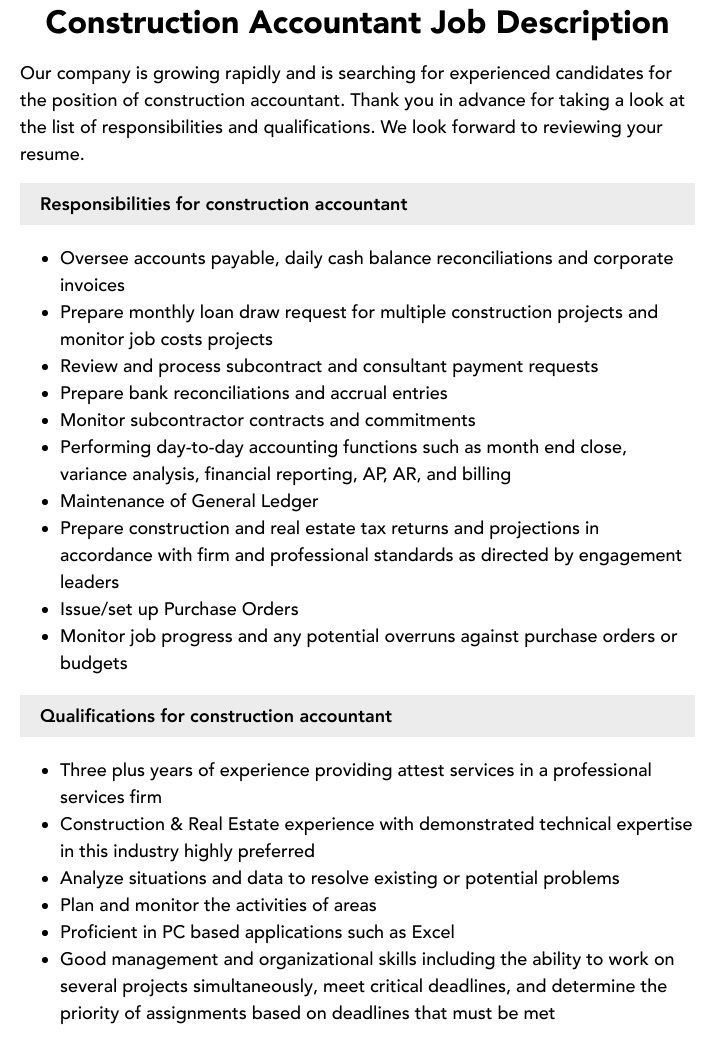

Our client is an expanding advancement and building company with head office in Denver, Colorado. With several active building work in Colorado, we are trying to find a Bookkeeping Aide to join our team. We are looking for a full time Accounting Assistant that will certainly be in charge of giving functional support to the Controller.

Receive and examine everyday billings, subcontracts, adjustment orders, order, check requests, and/or various other related paperwork for completeness and conformity with financial plans, procedures, budget, and contractual demands. Accurate processing of accounts payable. Go into billings, authorized attracts, click now order, and so on. Update monthly analysis and prepares spending plan fad reports for building jobs.

Pvm Accounting - Questions

In this overview, we'll dive right into different elements of construction accounting, its significance, the requirement tools used in this location, and its function in building and construction jobs - https://www.provenexpert.com/leonel-centeno/?mode=preview. From monetary control and price estimating to cash flow administration, discover just how accountancy can profit building and construction tasks of all scales. Construction bookkeeping describes the customized system and processes used to track monetary information and make tactical decisions for construction services

Report this wiki page